Life Style, AI, Finance: Optimizing Wealth with Tech!

Lifestyle significantly influences health and happiness. AI and finance are rapidly transforming global markets.

Exploring the intersection of lifestyle, artificial intelligence (AI), and finance reveals an evolving narrative shaping our future. Advancements in AI technology are redefining the finance sector, streamlining processes from personal banking to complex trading strategies. This synergy between AI and finance not only accelerates economic growth but also impacts individual lifestyles.

As people adapt to these tech-driven changes, they're reevaluating their spending patterns, investment approaches, and career paths in finance. Simultaneously, the lifestyle industry leverages AI for personalized recommendations and enhanced customer experiences, leading to a more attuned approach to health, wellness, and consumer behaviors. Understanding these trends is crucial for staying ahead in a world where technology, personal well-being, and financial health are increasingly intertwined.

Introduction To Wealth Optimization In The Digital Age

The way we manage money is changing fast. The digital age brings new tools to help us grow wealth. We look at the latest trends. We explore how technology shapes our finances.

From Traditional Banking To Fintech Revolution

Banks were once the only option for saving and investing. Now, fintech changes the game. People can now use apps and websites for financial needs.

- Easier money transfers

- Instant loan approvals

- Automated investing

The Emergence Of Ai In Personal Finance

Artificial Intelligence (AI) is a game-changer. It helps with budgeting, investing, and saving. AI makes smart decisions for your money.

| AI in Finance | Benefits |

|---|---|

| Chatbots for support | Fast and personalized help |

| Predictive analytics | Better investment choices |

Understanding The Concept Of Lifestyle Wealth Management

We need to combine money with life goals. Lifestyle wealth management makes this happen. It's about planning for now and the future.

- Know your spending habits

- Set clear financial goals

- Adjust as life changes

Artificial Intelligence: A Financial Game Changer

The financial world is on the brink of a revolution, courtesy of artificial intelligence (AI). Complex financial tasks now encounter the strategic simplification that AI brings to the table. As AI technology advances, the impact on finance becomes more profound. It ranges from smarter financial planning to tailored investment strategies. AI enables both seasoned and novice investors to optimize their financial health and wealth generation.

Algorithm-driven Financial Planning And Advisory

Imagine a system that understands your financial goals, habits, and preferences. Now, visualize that system creating a financial plan just for you. This is the reality AI brings to financial planning and advisory services. Algorithms can analyze your financial data in real time. They offer advice on budgeting, saving, and investing perfectly aligned with your personal objectives.

Ai And Big Data For Personalized Investment Strategies

AI harnesses the power of big data to craft personalized investment strategies. Investment is no longer one-size-fits-all. AI examines your risk tolerance, financial history, and market trends. It finds the best investment opportunities tailored just for you. Users witness a new era where their unique financial aspirations receive the right investment pairings.

Robo-advisors: Democratizing Access To Asset Management

Robo-advisors are the torchbearers of democratized asset management. They make professional financial advice affordable and accessible. With a blend of AI and algorithms, robo-advisors guide you through creating diversified portfolios. They do this with lower fees than traditional advisors. This means more people can grow their wealth without hefty management costs.

Predictive Analytics In Managing Risks And Returns

Financial markets are often unpredictable, yet AI's predictive analytics change the game. By analyzing vast amounts of data and past trends, AI forecasts market movements with impressive accuracy. Investors can anticipate risks and adjust their strategies. They secure their investments and capitalize on potential returns. Sensible investing becomes less of a gamble and more of an informed decision.

Integrating Lifestyle Into Financial Goals

The quest for a fulfilling lifestyle intertwines closely with savvy financial management. While dreams manifest in varied forms, from wanderlust to a cozy home, linking these aspirations with achievable economic targets paves the way to success. Let's explore how to weave lifestyle choices into financial blueprints seamlessly.

Bridging Daily Habits With Long-term Financial Planning

Lifestyle choices echo in our financial health. Small daily actions can grow into significant assets or debts over time. Here's a snapshot of strategies to align everyday habits with a prosperous future:

- Dine-In Delights: Favor home-cooked meals to foster savings and healthier eating.

- Smart Shopping: Embrace thrift and discount outlets for quality at lower costs.

- Active Transport: Choose walking or cycling to mix fitness with frugality.

Tech-enabled Budgeting For Life Milestones

Technology gifts us with powerful tools for milestone planning. Adapt to digital budgeting aids that match your life stage:

| Milestone | App/Solution | Benefit |

|---|---|---|

| Wedding | Wedding Budget Apps | Track Expenses |

| Home Purchase | Mortgage Calculators | Assess Affordability |

| Education Fund | Savings Plan Trackers | Standardize Contributions |

Luxury Living & Responsible Investing: Finding Balance With Ai

Aspire for luxury responsibly. AI-driven platforms now aid in harmonizing luxury cravings with ethical investment choices. Here's how to leverage AI for balanced financial health:

- Use AI algorithms to find ethical investments matching your values.

- Monitor spending on luxury items with smart financial apps.

- Set alerts for investment opportunities that suit your luxe lifestyle yet ensure value.

The Role Of Ai In Budgeting And Savings

Exploring the impact of AI on budgeting and savings uncovers a tech-driven approach to managing your finances. Artificial Intelligence now powers tools that simplify tracking expenses and boosting savings, without the usual strain on willpower. Let's dive into how AI is revolutionizing personal finance.

Automated Expense Tracking And Financial Discipline

Keeping tabs on where your cash flows is simpler than ever. AI-driven apps now categorize your spending in real-time. The benefits are twofold:

- Instant Overview: See all your transactions in one place.

- Smarter Budgeting: AI helps you set realistic budgets by learning your spending habits.

Smart Savings: Ai Algorithms For Optimizing Expenses

AI shines in identifying waste and suggesting tweaks. It factors in your financial goals, then:

- Analyzes spending patterns.

- Recommends cuts or shifts in spending.

- Adjusts plans as your income or expenses change.

Subscription Management With Ai: Curbing Unnecessary Spending

Subscriptions can bleed budgets dry without notice. AI tools:

- Track subscriptions renewals.

- Alert you before payments are due.

- Suggest which to cancel based on usage.

Investment Strategies Augmented By Technology

Technology revolutionizes how we manage our finances. It shapes investment strategies across various sectors. Artificial Intelligence (AI), blockchain, and cryptocurrency are at the heart of this evolution. These advancements enable smarter decisions, better analysis, and enhanced execution. Embracing tech can lead to groundbreaking strategies in the investment world.

Ai In Stock Market Trading: From Analysis To Execution

The stock market, once the playground for human intuition, now heavily relies on AI. The technology allows for:

- Precise trend predictions through deep learning algorithms.

- Automated trades that execute at optimum times.

- Real-time portfolio management to balance risk.

Crypto And Blockchain: The Tech-frontiers Of Investment

Cryptocurrencies and blockchain technology redefine asset classes:

- Decentralization

- Investors enjoy a system that's not controlled by any single entity.

- Transparency

- Every transaction is traceable and tamper-resistant.

- Accessibility

- Own parts of digital assets easily through tokenization.

The Impact Of Ai On Real Estate Investment Decision Making

In real estate, AI streamlines complex decisions:

- Analyze property values with sophisticated algorithms.

- Predict market trends using historical data.

- Implement chatbots for better customer interaction.

Credit: www.shrm.org

Security And Privacy In Tech-driven Finance

As technology leaps forward, so does finance. We embrace faster, smarter, and more efficient systems to manage our money. But with great technology comes great responsibility – the need to shield our financial activities from prying eyes and malicious entities has never been more critical. This section delves into how AI shapes security and privacy in tech-driven finance.

Ai In Fraud Detection And Financial Transaction Security

AI revolutionizes how financial institutions fight fraud. By learning from billions of transactions, AI models identify patterns that humans might miss. Let's discover AI's role in keeping financial transactions secure.

- Real-time analysis of transactions to spot irregularities instantly.

- Behavioral biometrics that learns how users interact with devices.

- Adaptive AI algorithms that evolve with new fraudulent tactics.

Navigating Data Privacy In Ai-enhanced Financial Services

With AI being data-hungry, protecting personal information is a must. Financial services tread this line cautiously, ensuring client data remains confidential even while AI enhances services. Learn about the privacy side of AI in finance.

- Implementing strict data access protocols.

- Using encryption to safeguard data at rest and in transit.

- Ensuring compliance with global privacy regulations like GDPR.

Building Trust In Ai Financial Management Tools

Trust forms the foundation of any financial service, more so when AI is involved. Building confidence in AI tools means clear communication on how AI works and its benefits. Let's look at ways to foster trust in AI-powered financial tools.

| Strategy | How It Fosters Trust |

|---|---|

| Transparency | Explaining AI decisions to users. |

| Control | Users have say over AI's role in their finance. |

| Security | Strong protections against unauthorized access. |

Future Trends And Predictions In Ai And Finance

The finance sector is on the brink of a revolutionary change. Futuristic technologies in artificial intelligence are aligning to redefine financial services. This segment delves deep into what the future holds for AI and finance. We unravel trends and predictions that are poised to sculpt an exhilarating tomorrow.

The Evolving Landscape Of Ai In Finance

Financial professions were some of the first adopters of early AI technology. They continue to break ground with AI advancements. The evolution is fast-paced with notable trends:

- Algorithmic trading optimizing strategies in milliseconds

- AI-driven credit scoring offering more accurate risk assessment

- Personalized banking experiences through chatbots and AI interfaces

New Frontiers: Ai In Sustainable And Ethical Investing

The demand for green and ethical investments skyrockets. AI is supercharging this space by:

- Analyzing sustainable investment opportunities

- Monitoring the social and environmental impact of investments

- Driving transparency in green finance

Preparing For The Next Wave: Ai And The Future Of Work In Finance

AI's influence in the finance workplace is growing. It is vital for professionals to stay agile with these changes:

| AI Impact | Workforce Adaptation |

|---|---|

| Automation of routine tasks | Upskilling and role diversification |

| Advanced data analysis | Enhanced decision-making skills |

| Improved compliance and security | Specialization in AI-driven security |

Credit: www.ft.com

Implementing An Ai-enhanced Lifestyle Financial Plan

Embracing the innovative intersection of lifestyle, AI, and finance generates a paradigm shift in managing personal wealth.

Step-by-step Guide To Adopting Fintech Solutions

Integrating AI into financial planning is more than a trend; it's a smart move. Begin the fintech journey with ease:

- Research the most recommended AI financial tools online.

- Select applications that align with your financial goals.

- Setup your account, entering financial details securely.

- Customize the tool for personalized budget tracking and insights.

- Monitor the app's advice and adjust your financial habits accordingly.

Measuring The Success Of An Ai-powered Financial Strategy

Evaluate the impact. Track financial progress with key indicators:

- Savings Growth: Monthly comparison of savings increases.

- Debt Reduction: Track reductions in debt over time.

- Investment Performance: Assess portfolio changes and net gains.

- Expense Optimization: Watch for reduced unnecessary spending.

Continuous Learning: Staying Updated With Tech In Finance

Financial tech evolves rapidly. Keep current with strategies:

- Subscribe to fintech news outlets and blogs.

- Join online forums with AI finance enthusiasts.

- Attend webinars and workshops for hands-on learning.

- Experiment with new AI financial tools regularly.

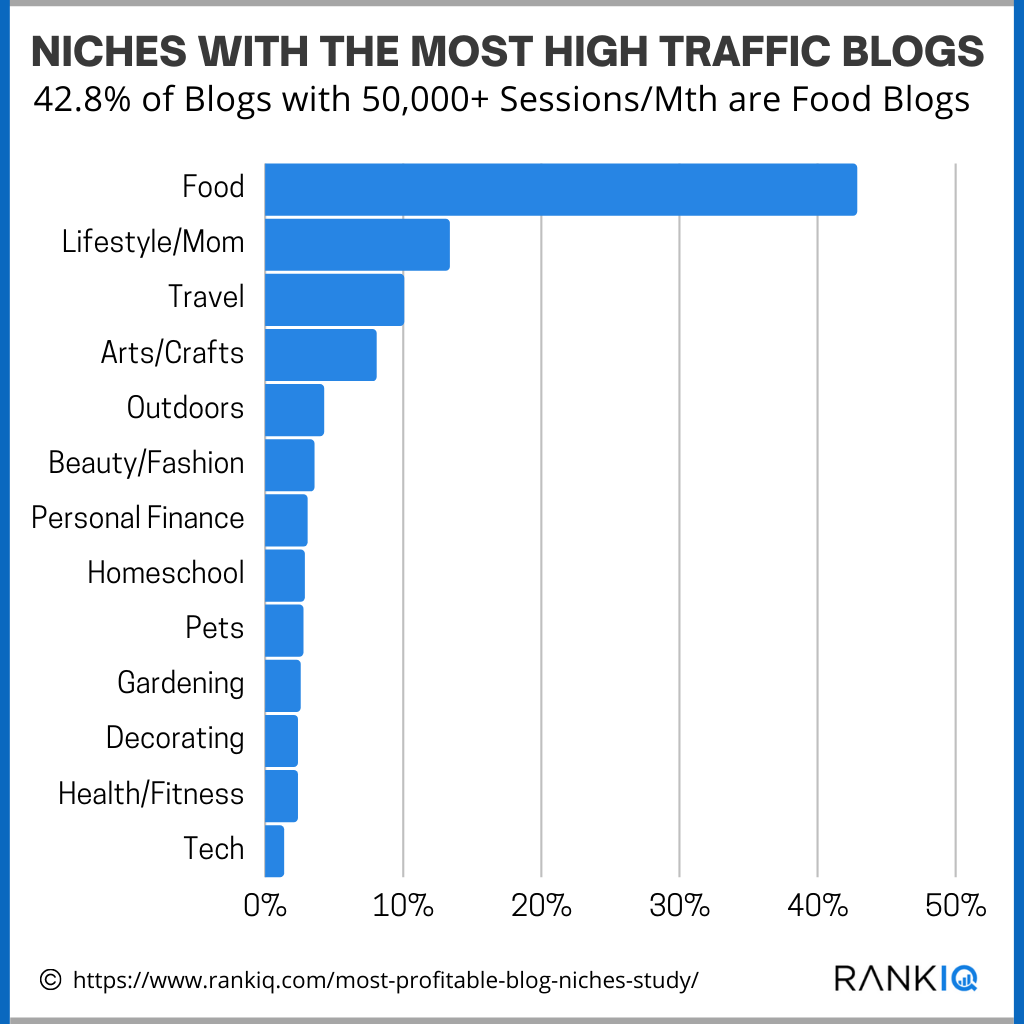

Credit: www.rankiq.com

Frequently Asked Questions On Life Style, Ai, Finance

How Does Ai Impact Lifestyle Choices?

Artificial intelligence influences lifestyle choices by providing personalized recommendations. AI analyzes user data to suggest health, entertainment, and shopping options. It tailors experiences to individual preferences, making daily decisions more informed and convenient.

What Are The Latest Trends In Lifestyle Ai Technology?

The latest trends in lifestyle AI include smart home devices, health-tracking wearables, and AI-powered personal assistants. These technologies learn from user habits to automate tasks, offer insights, and enhance quality of life through convenience and personalization.

How Ai Transforms Personal Finance Management?

AI transforms personal finance by automating budget tracking and investments. It provides financial insights and predictive analysis to help individuals make better money decisions. AI tools can also detect fraudulent activities, providing a more secure financial experience.

What Are The Benefits Of Ai In Daily Life?

Benefits of AI in daily life include increased efficiency, time savings, and personalized services. AI helps with routine tasks, such as scheduling and reminders. It also improves decision-making with data-driven insights in areas like shopping, fitness, and entertainment.

Conclusion

As we navigate the intersection of lifestyle, artificial intelligence, and finance, it's clear these realms are increasingly intertwined. Embracing AI can unlock a world of financial savviness and lifestyle enhancements. Thriving in this new era involves adapting and learning to leverage the tech at our fingertips.

Now is the time to innovate our daily lives, balancing technology with personal touch. Let's make the future ours.

Comments

Post a Comment